- What is Whimsical?

- Getting started with flowcharts

- Getting started with mind maps

- Getting started with wireframes

- Getting started with docs

- What can you do with Whimsical?

- Using Whimsical Boards

- Getting to know Whimsical - video guide 🎥

- Working with Whimsical’s infinite canvas - video guide 🎥

- 5 ways to create a new file

- Getting started with Whimsical AI

- How to create a new workspace

- How to use AI-assisted mind mapping

- Customizing file and folder icons

- Mentions in Whimsical files

- Customizing diagram shapes

- Getting started with sequence diagrams

- Using the command menu

- Commenting in Whimsical files

- Getting started with flowcharts

- Getting started with mind maps

- Getting started with wireframes

- Using Whimsical Boards

- Mentions in Whimsical files

- Customizing diagram shapes

- Using sections on the Whimsical canvas

- Sketch on the canvas with freehand drawing

- Annotating files for more detail

- Text-to-object pasting options

- Adding and displaying links in Whimsical files

- Linking to sections and objects

- How to draw a line

- How to filter selected objects

- Presenting in Whimsical

- Voting on task cards and sticky notes

- Using the timer in boards

- Working with the grid and auto-alignment

- Working with connectors

- Does Whimsical have cloud architecture icons?

- Using tables in Whimsical

- Using sticky notes in boards

- Optimizing performance in larger files

- Embedding external content into Whimsical

- Using spellcheck

- Setting custom thumbnails

- How overlays work in Wireframe mode

- Hiding cursors while collaborating

- Measure between objects in Boards

- Uploading files to Whimsical

- Getting started with sequence diagrams

- Commenting in Whimsical files

- Getting started with docs

- Mentions in Whimsical files

- Text-to-object pasting options

- Adding and displaying links in Whimsical files

- Linking to sections and objects

- Using tables in Whimsical

- Embedding external content into Whimsical

- Using spellcheck

- Changing page width and text size in Docs

- Collapsing text with toggles

- How to create a new workspace

- Requesting file access

- Workspace discovery settings

- Sorting files and folders

- Changing workspace members’ roles

- Adding and removing members

- Creating and managing teams

- Requesting workspace editor access

- Linking between files

- Member roles in Whimsical

- How to delete a workspace

- How to upgrade your workspace

- Guest access

- Renaming your workspace

- Offboarding users

- Consolidating workspaces

- Uploading files to Whimsical

- Organizing your work with tabbed folders

- SAML

- Setting up SAML session expiry

- Security

- Prevent new workspace creation

- Customizing file and folder icons

- How to draw a line

- How to filter selected objects

- Does Whimsical have cloud architecture icons?

- How overlays work in Wireframe mode

- Moving and copying files

- Using Whimsical on mobile

- Does Whimsical have a dark mode?

- File version history

- Why are the colors of some elements toned down?

- Does Whimsical support offline mode?

- Teams, workspaces & sections explained

- Does Whimsical work on iPad?

- Free viewers commenting in workspaces

- Syntax highlighting in code blocks

- Whimsical desktop app

- Is Whimsical available in other languages?

- Inverting the zoom direction in Whimsical so it works more like Sketch

- Troubleshooting issues and reporting bugs

- How to add emojis

- Team FAQs

- How to restore deleted files from the trash

- Searching in your Whimsical workspace

- Organizing files in your workspace

- I’ve upgraded but still don’t have access to the paid features

- Why can't I edit my files?

- Reporting content in Whimsical

- Does Whimsical have an affiliate or referral program?

- Collaborating with others in real time

- Sharing files and managing access permissions

- Hiding cursors while collaborating

- How to switch between workspaces

- Sharing feedback and feature requests

- Embedding & integrating boards with Jira Issues

- Integrating Whimsical with Google Docs

- Embedding files in ClickUp views

- Embedding files in Asana

- Embedding Whimsical files

- Whimsical AI Diagrams for ChatGPT

- Creating Jira & Confluence Smart Links for Whimsical Files

- Embedding files in Guru

- Embedding files in Trello

- Embedding & integrating boards in Notion

- Integrating Whimsical and GitHub

- Embedding files in Zendesk

- Support Whimsical embeds in your app with EmbedKit

- Whimsical previews and notifications in Slack

- Embedding files in Canva

- Integrating Whimsical and Linear

- Embedding files in Nuclino

- Embedding files in Monday

- Embedding files in Medium

- Embedding files in Slab

- Embedding files in Coda

- Whimsical API (Beta)

- SAML

- SAML SSO in Whimsical

- SAML SSO with Okta

- SAML SSO with Auth0

- SAML SSO with OneLogin

- SAML SSO with Microsoft Entra ID (Azure AD)

- SAML SSO with Google Workspace (previously G-Suite)

- SAML SSO with Active Directory Federation Services (ADFS)

- SAML SSO with other identity providers

- Setting up SAML session expiry

- Managing email changes with SAML and SCIM

- SCIM

- Setting up SCIM with Okta

- Setting up SCIM with JumpCloud

- Setting up SCIM with Entra ID (Azure AD)

- SCIM provisioning with Groups in Okta

- SCIM user provisioning in Whimsical

- SCIM provisioning with Groups in Entra ID (Azure AD)

- Security

- Setting up Two-factor Authentication (2FA)

- Prevent new workspace creation

- Whitelisting Whimsical domains

- Signing in with your Whimsical account on multiple devices

- Contact us

Sales tax and VAT

Important: The taxation described in this article came into effect on December 1st, 2024, for all new and existing accounts.

Whimsical is required by law to charge sales or value-added tax in certain geographies.

We determine whether or not to charge tax, and calculate the tax rate based on your billing address. Learn how to set or update your billing address in this article

If you provide a valid tax ID for the address associated with your Whimsical account, tax will not be added to your invoice.

Note:

- Prices shown on the Whimsical website do not include sales tax or value-added tax — You can see any added tax on the invoices in your subscription settings.

- You can request Whimsical's sales tax registration IDs from our Trust Center.

US sales taxCopied!Link to this section

We include sales tax in the following US states. If your state is not listed, you won’t see any sales tax on your invoices.

- Massachusetts, MA

- Maryland, MD

- New Jersey, NJ

- New York, NY

- Ohio, OH

- Utah, UT

- Washington, DC

- Washington, WA

Value-added tax (VAT)Copied!Link to this section

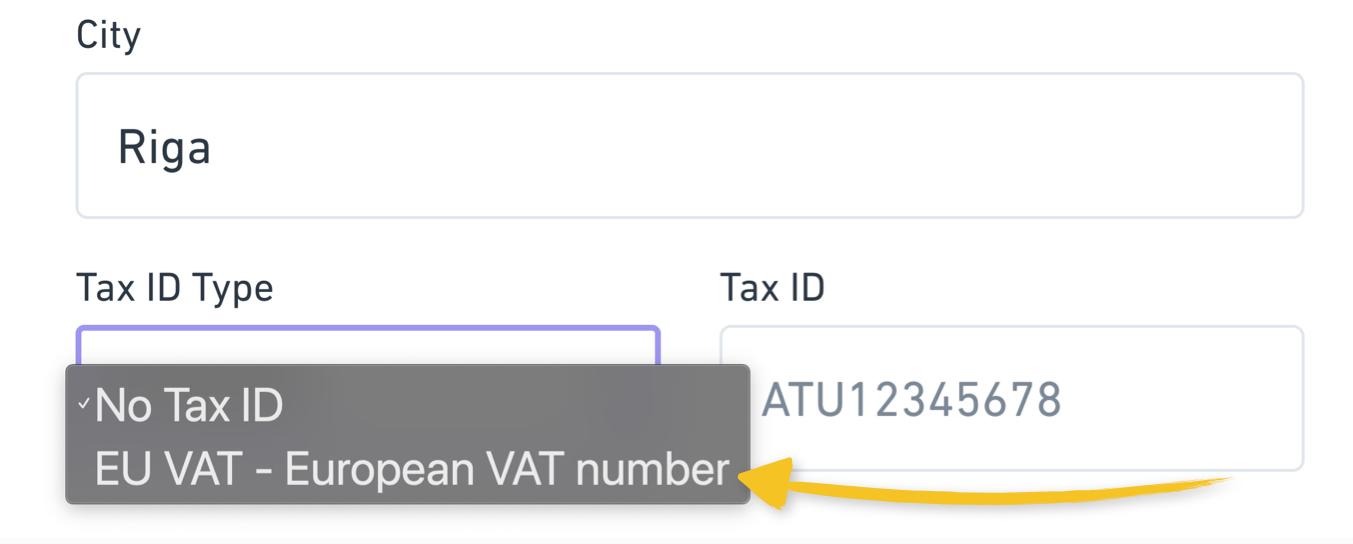

You can update your billing information to include a tax ID on future billing statements and invoices.

Tip: Be sure to include the two-letter country prefix when entering your EU tax number.

E.g. "FR" for France, "LV" for Latvia

CanadaCopied!Link to this section

If the address associated with your Whimsical account is in Canada, Canadian GST/HST will be added to your purchase. If you provide a GST/HST ID you will not have GST/HST added to your future invoices.

Provincial Sales Tax (PST or QST) may also be added to your purchase if your billing address is in British Columbia, Manitoba, Saskatchewan, or Quebec.

Quebec business customers that are registered for Quebec sales tax (QST) and provide a QST ID will not have QST added to their invoice going forward

European UnionCopied!Link to this section

European Union (EU) VAT will be added to your purchase if your billing address is in the EU. If you have provided a valid VAT number, no VAT will be charged on the invoice. However, you may be required to report the purchase of services through your VAT return via the reverse charge mechanism.

If you haven't provided an EU VAT number when an invoice is generated, VAT will be charged until you provide a valid VAT number.

We use the official EU tax validator to verify EU VAT numbers - if your VAT number is not validated, VAT will be added to your invoice.

If you are based in the EU, add your VAT number with "EU VAT" as the Tax ID Type — Be sure to include the two-letter country prefix. E.g. "FR" for France, "LV" for Latvia

United KingdomCopied!Link to this section

United Kingdom (UK) VAT will be added to your purchase if your billing address is in the UK. If you have provided a valid VAT number, no VAT will be charged on the invoice. However, you may be required to report the purchase of services through your VAT return via the reverse charge mechanism.

If you haven't provided a UK VAT number when an invoice is generated, VAT will be charged until you provide a valid VAT number.

Note:

- If a tax ID is not provided before you are charged, we cannot retroactively refund the tax paid. In this case, you can ask your local tax authority for reimbursement.

- For help with tax exemption for other reasons, you can contact our Support team at any time.

For a visual guide to all tax regions, check out this Flowchart: